Nothing in this article should be taken as financial advice.

Uniswap has exploded across the crypto social media channels over the last 24 hrs with the introduction of its $UNI token and public airdrop to people who had used the platform since September 1st. Those users received an average of 400 $UNI which was worth over $3,400 dollars at the peak price today of $8.50.

To be clear, each WALLET used to transact on the Uniswap network *BEFORE 9/1/2020 is eligible for 400 UNI, so some users got many multiples of 400 UNI. With the token still in price discovery the price could easily 10x from here.

Uniswap’s governance token, UNI, launched on Wednesday night has been on a roller-coaster ride in the past 24 hours, but despite the price volatility the total market cap of UNI could make the automated market maker (AMM) one of the most valuable decentralized finance (DeFi) projects in the coming years.

Based on 1 billion tokens outstanding and a current market price of $6.50, the project has an implied market value of approximately $7 billion on a fully diluted basis, according to CoinGecko. There is currently $829.7 million worth of crypto assets committed to Uniswap, according to DeFi Pulse.

Since its launch, UNI’s prices reached a high of $8.55 before going back down to around $6.50 at the time of writing no doubt helped by $UNI becoming available on Coinbase exchange.

What is Uniswap?

What is Uniswap exactly? And if you’re not able to easily answer that question, you probably don't know how to use it.

Uniswap is the decentralised swap protocol that has recently taken the crypto market by storm. Fuelled by the new wave of interest in ‘DeFi’ crypto projects, just recently Uniswap outdid Coinbase in exchange volume.

Many took to social media to praise UNI’s initial airdrop. A minimum of 400 UNI was airdropped to everyone who used Uniswap prior to September. Some called it “stimulus for Ethereum users.”

Using Uniswap instead of Coinbase, Binance, or any of the other centralised exchanges has significant advantages.

As a venture capital-backed project, Uniswap raised $11 million in a Series A funding led by Andreessen Horowitz, along with Union Square Ventures, Paradigm and a few other prominent funds in early August, and sold shares of Universal Navigation Inc., the company behind the protocol, to its investors.

Some 178 million UNI (about 17.8% of the total supply) will be allocated to investors with a four-year vesting cycle which, at the current price, is worth approximately $600 million. When the exchange did its Series A round, there was speculation investors could potentially receive returns through a protocol fee of 0.05%, which was introduced to the second version of Uniswap. However, the fee function is currently off.

Uniswap Explained

Decentralised exchanges have promised much, but underdelivered (some would argue they were never really decentralised in any case) in crypto for a while now.

There was Ether Delta, then IDEX, Kyber, and a few others. Since 2017, none of these ‘DEXes’ (short for Decentralised Exchange) really took off — until Uniswap.

Uniswap isn’t a cryptocurrency exchange in the ordinary sense. It’s basically a framework enabling people to swap tokens directly from our own personal wallets. No intermediaries, no custody, no KYC and no trust required.

The way Uniswap does this is by providing smart contracts allowing you to do 3 things:

- Swap tokens

- Earn fees by adding liquidity

- Remove liquidity from pools

Uniswap is a peer to peer marketplace for token trading much like the Pirate Bay is for sharing the files.

Advantages of Uniswap

Uniswap has some advantages over traditional crypto exchanges.

● You don’t have KYC (Know Your Customer) verification. Instead, trading is done directly from your wallet, so your public wallet address is the only identifier involved.

● Since Uniswap is non-custodial, meaning the protocol doesn’t hold funds, it’s as secure as the Ethereum blockchain itself. Uniswap’s smart contracts have been audited by several teams, including those who verified the MakerDAO contracts.

● Anyone can create an ERC20 token and pair it with ETH to generate liquidity for the new pool. This means Uniswap gives you instant trading access to new tokens faster than anywhere else.

● Trading only costs 0.3% fee per trade. Centralised exchanges tend to charge 0.5% or more per spot trade.

● Unlike at centralised exchanges, you hold your private keys when you trade using Uniswap.

Disadvantages of Uniswap

As with most things in live, there are a few downsides:

● Since Uniswap runs on Ethereum, interactions with Uniswap smart contracts all require gas fees paid in ETH. As was seen in August 2020, too many Uniswappers equaled Ethereum network congestion which in turn translated into high gas fees. Ethereum 2.0 should alleviate this issue, though (Another time, another guide).

● If you don’t set your gas limit fees correctly, your transaction might fail. When it fails, you still pay for the attempt, meaning you lose gas fees but don’t get the trade you wanted.

● The advantage of anyone being able to create liquidity for tokens has a downside. Scammers create fake tokens to sucker people into providing liquidity for them. There are easy ways to spot these, which I’ll explain later.

How To Use Uniswap

When you trade tokens using Uniswap, you’re just swapping them. Users add token liquidity to pools before you come along and deposit your tokens. In return for your deposit of token A to the pool, you receive token B in your wallet.

Anybody can use Uniswap, and even more interestingly, since Uniswap is a protocol, anyone can create an application on top of it. Despite that, Uniswap’s original app is still the most popular.

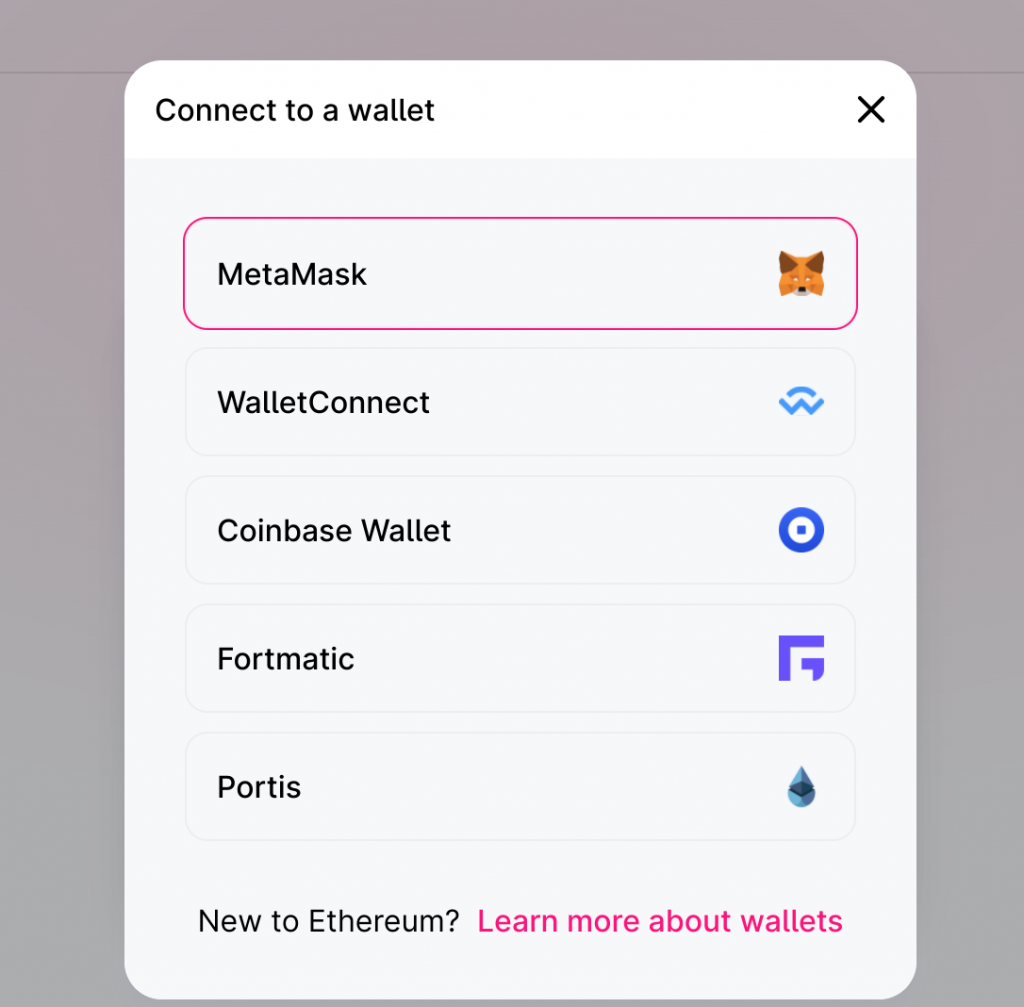

First – Get a MetaMask Wallet

The first thing you should do is create a MetaMask crypto wallet. MetaMask lets you connect to blockchain applications like Uniswap from your browser — it’s pretty handy.

You can connect to Uniswap with other wallets like Trust Wallet or Coinbase wallet, but MetaMask is recognized as the most stable and trusted wallet to use. Most Uniswappers use MetaMask.

MetaMask installs as a browser extension. After installing, create your account, write down your seed phrase (NOTE! don’t ever lose or share this).

Buy Some ETH

You will need ETH in your wallet before you do anything, so make sure you buy some here.

Uniswap only deals in Ethereum-based digital assets, otherwise known as ERC20 tokens. To swap these, you have to pay a gas fee to the Ethereum blockchain — gas fees are paid in ETH.

Even if you already have ERC20 tokens and want to trade these for ETH or other ERC20s, you’ll still need Ethereum to cover the gas so be warned. If you don’t have ETH in your MetaMask wallet, your trades won’t go anywhere. There is no way around this.

How much Ethereum should you buy? Well, it depends on how much swapping you plan to do and how congested the network is.

The best way to calculate all of this is to visit the gas station — ETH Gas Station ⛽️

You should always plan on a roundtrip, which means gas for the swap, plus gas to move your new tokens back to Uniswap if you’re trading, or another wallet (such as a hardware wallet)

Head over to Uniswap

Jump over to Uniswap.org. Once there, you’ll see two options:

- Launch App

- Read the Docs

Since this is your first time, it wouldn’t hurt to read the docs first. There’s a lot of big language stuff about automated liquidity protocols etc. If you care, these docs are a great read.

Launch Uniswap App

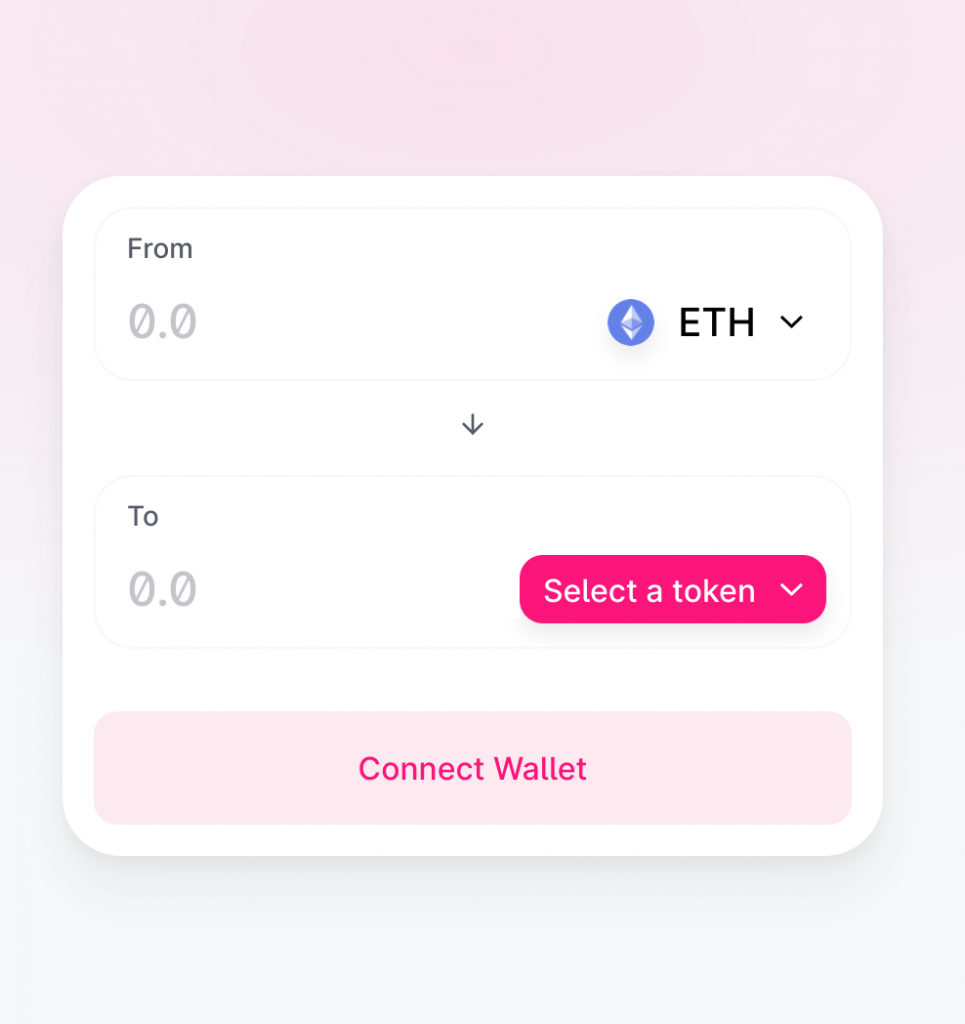

After you have finished reading… you did read the docs didn't you? Click Launch App. This is the screen you find:

Assuming you’re not logged in to MetaMask, you’ll see the option to connect to a wallet in the upper right-hand corner. Go ahead, click it. Now you get the connect to a wallet screen.

Click MetaMask, which will pop up your MetaMask extension and prompt you to log in. Enter your credentials. Once done, you’re taken back to the swap screen. Now It’s time to swap.

Select a Token

If this is your first time using Uniswap, you’re probably trading ETH for an ERC20 token. By default, Uniswap has ETH in the from field and allows you to select the token of your choice in the to field.

This means you’re sending ETH from your wallet to the liquidity pool for the token selected.

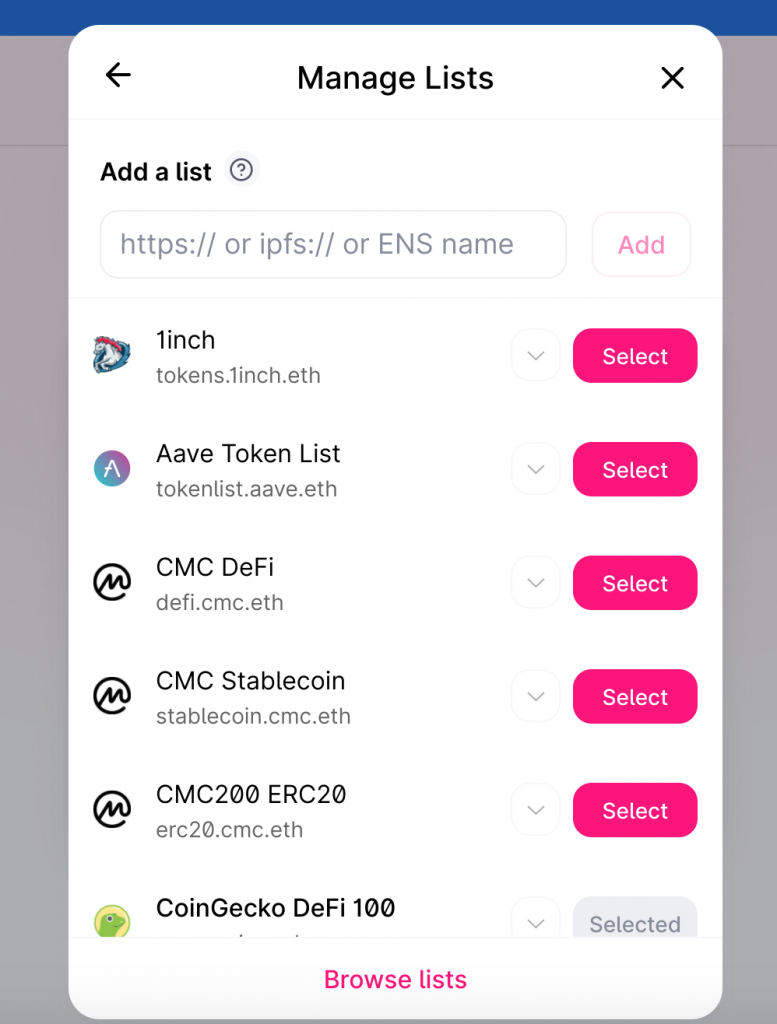

Clicking select a token brings up a token lists screen. These are prepackaged lists of tokens according to categories, making it easy for you to browse tokens along the lines of your interests.

Choose a list, then browse and select the token you want.

Pro tip: If you know ahead of time which token you want to buy, use CoinGecko to get the token contract address, then paste it at the end of → https://uniswap.info/token/. This method takes you directly to the token and lets you trade or add liquidity.

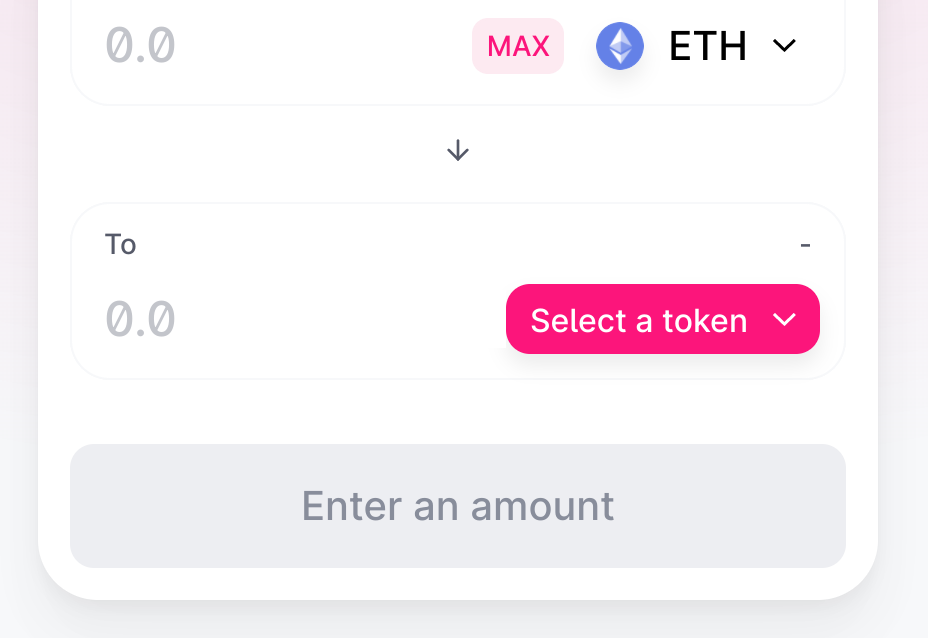

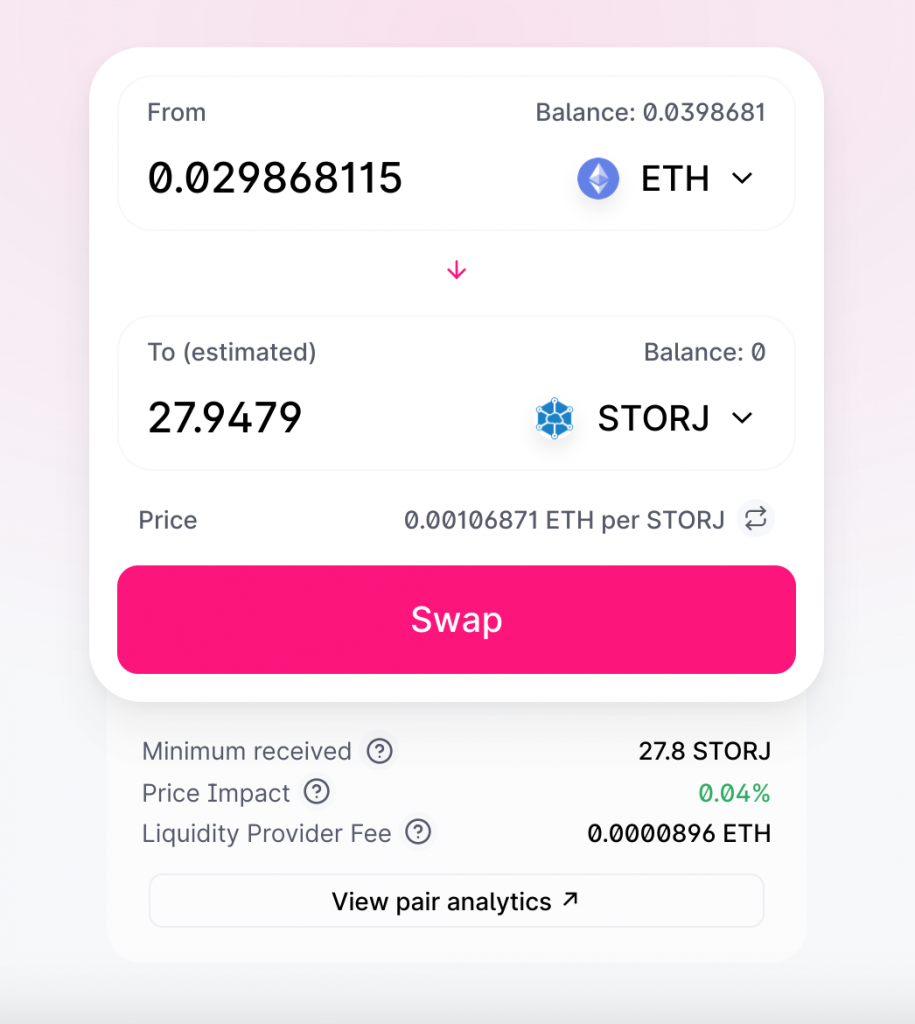

Enter Amounts

Now, enter the amount of ETH you’re swapping in the from line.

The to line will populate with the equivalent amount for the token you’re buying.

Hit Swap

Once everything is set up correctly, and you’re ready to go, hit swap.

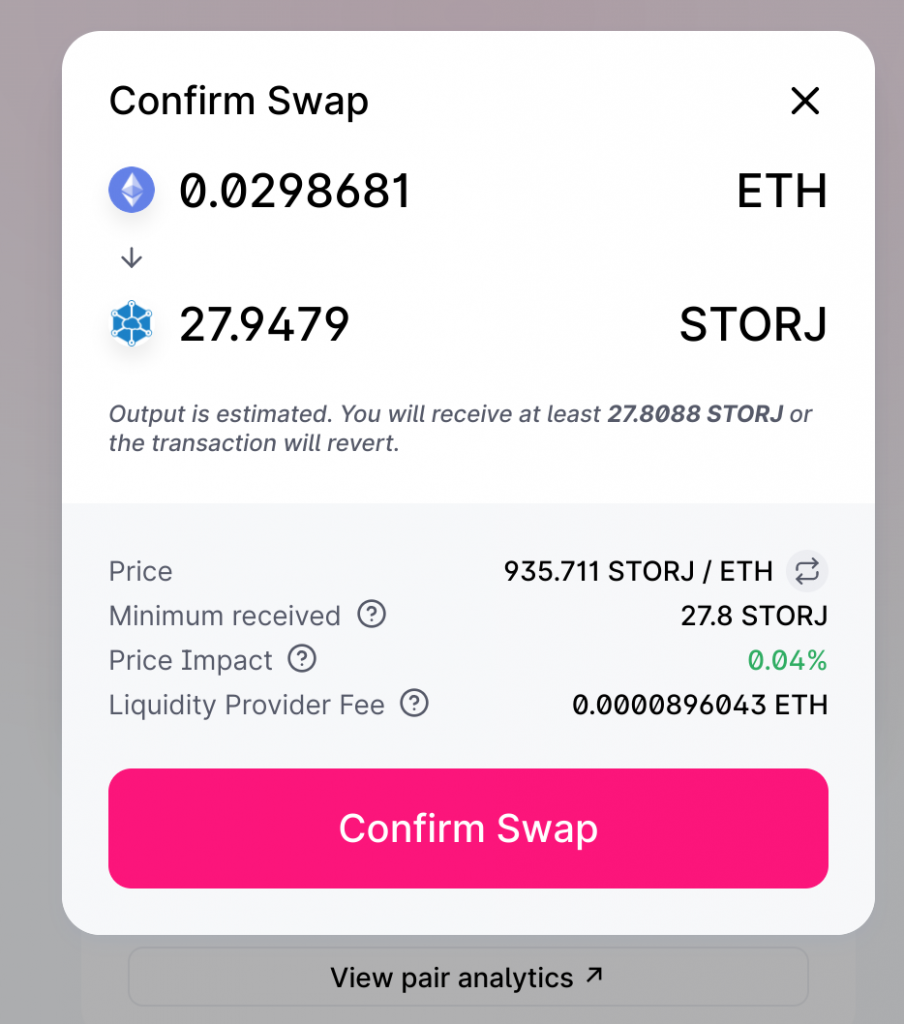

The next screen confirms the details of the transaction. If all looks good and as it should, Confirm swap.

After you confirm the swap, MetaMask will pop up, asking you to confirm or reject the transaction.

Receive Tokens

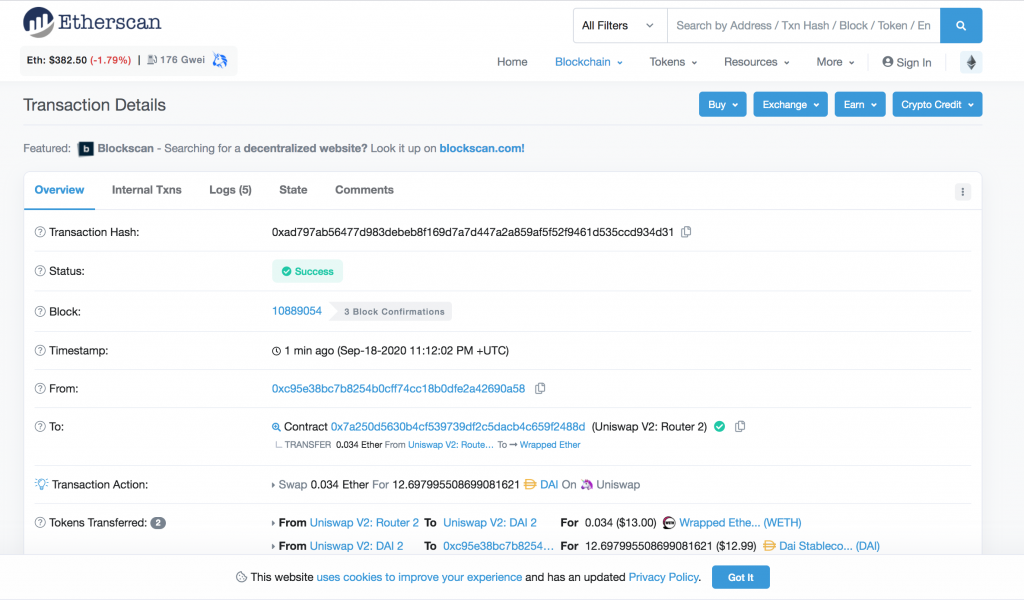

Once you confirm the transaction in your MetaMask wallet, you have to wait a few moments for the tx to hit the blockchain. You can watch this process in action by clicking the Etherscan link given by Uniswap.

The more congested Ethereum is, the longer these confirmations will take. After a short wait, you’ll see your tokens in your MetaMask wallet by clicking assets.

You can now keep these tokens in your MetaMask wallet, sell them when, or if, they moon.

Uniswap Tips, Tricks, & Shortcuts

Uniswap is a very straightforward exchange protocol, but, to the uninitiated, there are few tips and tricks to make your experience drama-free.

How To Avoid Scam Tokens ☠️

Avoiding scam tokens is your top priority. Uniswap lets anyone create liquidity for any ERC20 token — even tokens that are ‘Sexton’ (cockney: ‘Sexton Blake = Fake).

For example, a hyped token $FAKE (not a real token name) is coming to market; people can’t wait. Suddenly, $FAKE shows up on Uniswap. Wait, the $FAKE team hasn’t confirmed anything, you wonder whether you’ve caught it early.

People start throwing ETH at it. There’s $100K sent to the pool before you know it when suddenly the real $FAKE team updates their Telegram saying they haven’t released the token yet!!

To avoid a scam like this, always verify token contracts using CoinGecko and Etherscan.

On Etherscan, there’s a convenient field called holders. This is the number of wallets holding the token. This field should have many holders — if you see a token with a suspiciously low number of holders, it’s likely to be a fake.

Always check the contract address so that it lines up on Uniswap, CoinGecko, and Etherscan before swapping.

Avoiding Failed Transactions

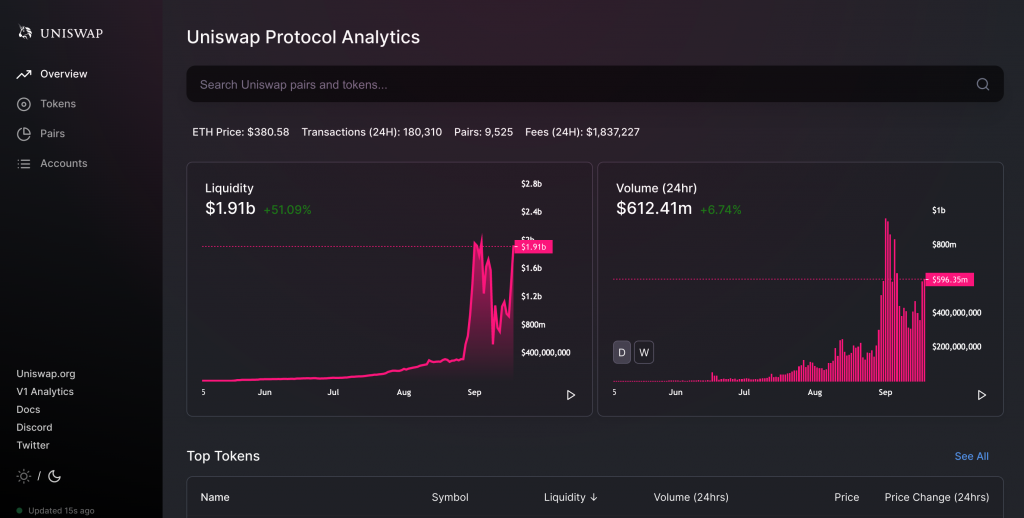

Failed transactions are extremely annoying. You don’t get the tokens you wanted, and ETH gets deducted from your wallet to cover gas. The best thing to do is to avoid failed Uniswap transactions in the first place. To do this, make terrific friends with the Uniswap analytics page.

Search for the pair you want to trade, let's use DIA/ETH for this example. Now, scroll down to transactions, then click swaps. On the left column, you’ll see swap ETH for DIA and swap DIA for ETH. Click the one that applies to your swap.

This will take you to the blockchain record for that swap, allowing you to see the transaction details. Scroll down to the transaction fee field, then click to see more just below it.

View a few transactions like this to see what gas price (GWEI) was used in recent successful transactions. Use this info to set your swap for success ahead of time.

Conclusion

This is the long promised decentralised exchange technology, and it’s so well crafted that many traditional exchanges are feeling the heat. That’s why they’re listing digital assets more quickly these days, fearing that Uniswap will take all the volume away. Binance, Coinbase have been very quick to make $UNI trading available to their users in order to not lose face.

Comments are off this post!