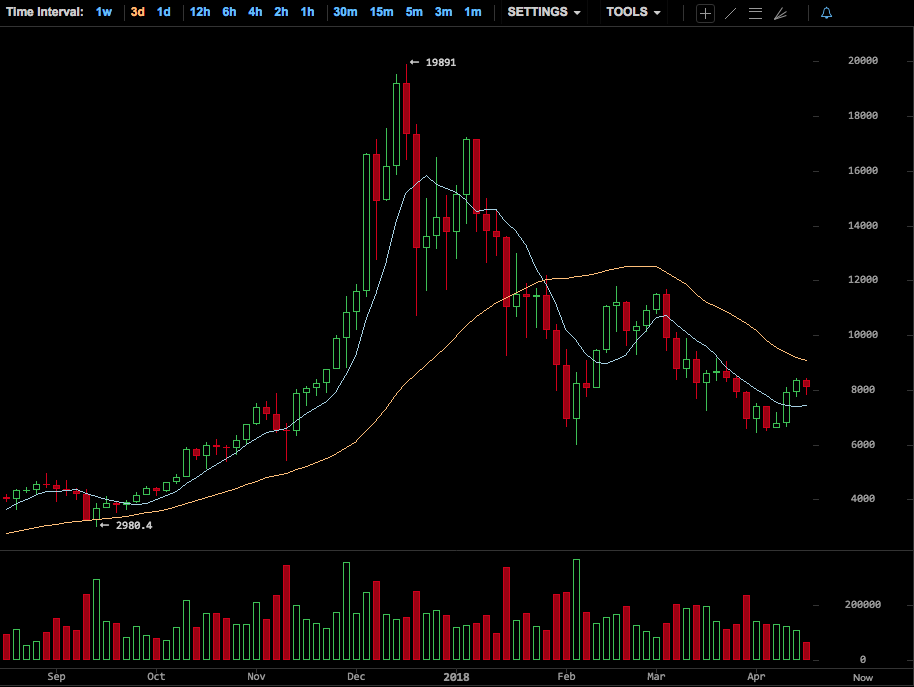

With the end of U.S. tax season upon us, Bitcoin bulls believe that the digital currency will finally begin its next run to prices over $20,000. Despite these predictions from bitcoin bulls that prices would recover, prices pulled back dramatically below $8,000 late Tuesday and have recovered slightly to $8,090 at the time of writing.

Since December 2017 it has been a downward trajectory for cryptocurrencies, with the cryptocurrency market cap plummeting from a high of $820 billion all the way down to $250 billion. This came after the mainstream media began to pile onto cryptocurrencies in a manner that was far from positive.

Despite a bearish Q1 2018, the sentiment portrayed by the public and mainstream media sources appears to be shifting. Investors are becoming cautiously optimistic as they have seen some strength return to the cryptocurrency market, with Bitcoin prices climbing over 20% in a single week. However, this may be premature as the latest small rally may only be a ‘bull trap’.

Tom Lee, co-founder of Fundstrat, has projected that Bitcoin will reach over $25,000 by the end of the year, 25% higher than the prices seen during the 2017 peak in December. Along with this speculation, bullish signals have returned, in the form of positive sentiment, which has begun to pile up.

Spencer Bogart, a partner at Blockchain capital, took a stab at reasons for the market decline by stating:

“Tax-selling has been a significant factor in downward crypto prices over the past few weeks. I would expect this downward pressure to abate after tax day. With the long-awaited passing of the U.S. tax day, bullish investors expect that this will relieve a large majority of selling pressure seen on the market.”

According to Tom Lee, an estimated $25 billion is owed to the IRS for “realized gains” for U.S. households last year. To cover the taxes required for these cryptocurrency gains, many have begun selling their cryptocurrencies for fiat currencies in order to procure the funds needed to pay their tax bills.

The man behind the #bitcoin tax selling theory, @fundstrat's Tom Lee, breaks down why the #cryptocurrency is set for a big rally pic.twitter.com/Ulv5wqlfab

— CNBC's Fast Money (@CNBCFastMoney) April 16, 2018

Along with this speculation about taxes, there have been other positive indicators showing that Bitcoin is ready for more public consumption. The SEC recently indicated that they will be taking a second look at Bitcoin ETFs. It is now clear that this would not be any old ETF. It would be a widespread, highly liquid Bitcoin ETF which would reach millions of new investors.

Along with a public ETF, large financial organizations such as Venrock have announced their plans to make investments in this evolving industry. Venrock is a prominent venture capital firm which has invested over $2.5 Billion dollars in companies like Intel and Apple. Venrock is poised to pour large sums of money into blockchain related startups in a move which obviously emanates classic venture capitalism.

Venrock partner David Pakman stated:

“We wanted to partner with this team that has been making investments and actually helping to architect a number of different crypto economies and crypto token-based projects.”

It is clear that with this move into the space that Venrock is willing to invest in companies which will not only grow the blockchain space but the cryptocurrency space along with it.

Tim Draper, famous venture capitalist and Bitcoin proponent, is even more optimistic about the digital currency’s future, predicting that it will reach over $250,000 by 2022.

On April 12th, Draper confidently announced:

“I’m thinking $250,000 a bitcoin by 2022… Believe it, it’s going to happen; they’re going to think you’re crazy but believe it, it’s happening, it’s going to be awesome!”

Oops! I predicted $250k in 2022. My tweet last night was missing a zero. $250k is the number!

— Tim Draper (@TimDraper) April 13, 2018

These bullish signals, coupled with increased media presence, might be indicators that Bitcoin is getting ramped up for another price surge that will put cryptocurrencies back into the public eye once again. As things begin to pick up, we may see that Mr.Draper’s statement won’t be as outlandish as it currently seems.

Jack Tatar, co-author of “Cryptoassets: The Innovative Investor’s Guide to Bitcoin and Beyond,” said prices could still rebound after Tax Day, but it won’t be immediate.

Comments are off this post!