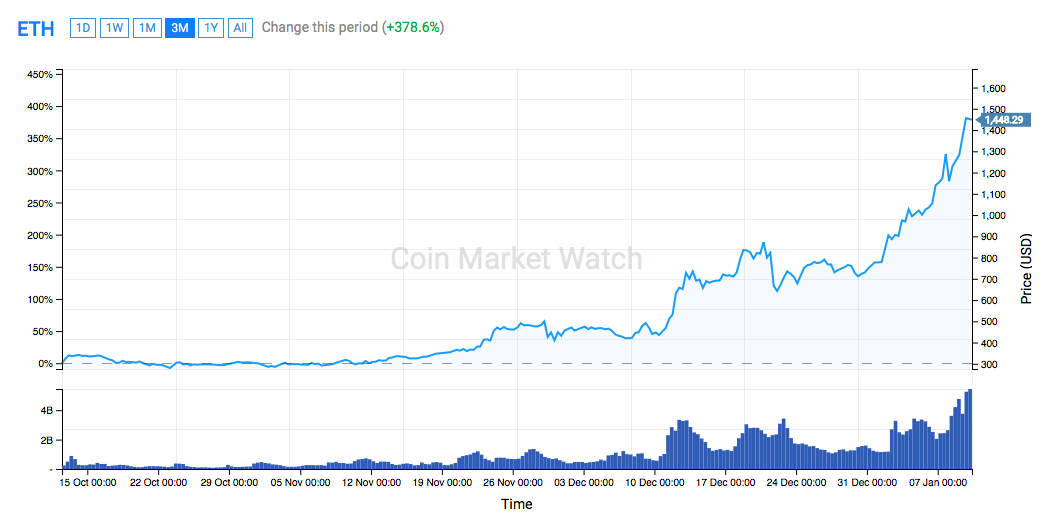

The price of ether has risen to new all time highs this week, hitting over $1500 earlier today. In doing so the cryptocurrency has reclaimed its place as the second-largest blockchain by total value, days after being temporarily surpassed by Ripple’s XRP token. However, as with that controversial market move, the massive uptick in value has also highlighted some of the growing pains faced by it’s increasing popularity.

One of these issues is the increase in transaction costs, which have become so high that the cryptocurrency was taken off Bittrex, a major exchange, this weekend. Largely discussed on internal developer channels, reports of the problems to the public have been unusually quiet, scarcely touching Reddit, Twitter and other active ethereum forums.

Bittrex, the fourth largest cryptocurrency exchange in the global market with a $2.7 billion daily trading volume, suspended the creation of Ethereum deposit addresses due to increasing fees and network congestion.

Bittrex wrote:

“Due to incredibly high gas prices, we’re preventing new ETH and asset deposit addresses from being created. Existing deposit addresses will work as normal,”

This was partly caused by a glitch in the “gas oracle”, the software that determines how much a transaction should cost to send, has caused a massive inflation in user fees, with some paying far higher than is necessary for a transactions to go through.

More forward-looking projects are showing signs of strain also. The test network for Casper, ethereum’s long-awaited ecologically friendly alternative to proof-of-work, and arguably a core tenet of its value proposition, is currently splitting into incompatible forks.

Ethereum heavyweight Vlad Zamfir tweeted recently in response to the issues:

Still not safe or scalable https://t.co/RgnAhzIe4f

— Vlad Zamfir (@VladZamfir) January 4, 2018

According to Etherscan, the Ethereum network is currently processing more than 1.3 million transactions on a daily basis. It has a daily transaction volume that is larger that of all cryptocurrencies in the global market combined, including bitcoin.

Even though Ethereum is a scalable blockchain network with sufficient on-chain scaling and innovative second-layer scaling solutions such as Plasma and Sharding in development, it is struggling to handle the massive increase in demand for ether. For a blockchain network, a daily transaction volume of more than one million transactions is difficult to handle. By comparison Bitcoin, the most valuable cryptocurrency in the market, is only processing just over 400,000 transactions per day, less than 40 percent of the Ethereum network.

Ethereum was developed to handle more transactions than Bitcoin, as it has to operate as the base protocol for large-scale and commercial decentralized applications. However the rapid rise of popularity in decentralized applications like CryptoKitties, EtherDelta, and 0x has led to a congestion of the Ethereum network.

The developers of Bankex, who introduced the first practical implementation of Ethereum co-founder Vitalik Buterin’s off-chain scaling solution Plasma, wrote in a blog post that decentralized applications that require many thousands of transactions to execute complex orders have become an issue for Ethereum:

“While innocuous at a glance, the project has become a problem for the Ethereum ecosystem. The CryptoKitties multiply, are bought, sold, rented for breeding, in other words, involved in myriads of transactions, taking up the largest volume of Ethereum traffic (20 percent). This causes many transactions that had previously taken seconds to currently be either delayed to 10 minutes, or fail entirely.”

Because apps like CryptoKitties place a massive burden on the Ethereum network by requesting large transactions per request, for instance the acquisition or selling of digital cartoon kittens counts as one on-chain transaction, it is challenging for the blockchain network to maintain low transaction fees, solely through on-chain scaling.

In the upcoming months, the Ethereum development team expects to integrate Plasma and Sharding into the main network and process large transactions and requests off-chain. Plasma allows the existence of several blockchains that are interconnected to each other to process transactions on different blockchains. The segregation of transactions relieves the main Ethereum blockchain from serious congestion.

Until then, the transaction fee of ether could surpass $1 to $2 in the short-term and could prevent exchanges like Bittrex from processing orders at the current rate. If depositing and withdrawing ether costs more than $1 to $2, cryptocurrency exchanges could disallow deposits and withdrawals below $50 from being processed or prevent ether deposit addresses from being created, similar to Bittrex.

Comments are off this post!