Future cryptocurrency trading platforms will look very different from what we are used to today. With atomic swaps and decentralized trading platforms becoming more commonplace, things will get pretty interesting in the future. Recently, exchanges Binance and Kyber Network released news of progress toward the future of decentralized exchanges: Binance announced the launch of a decentralized exchange, and Kyber Network made their decentralized exchange beta available to the general public.

Even though centralized trading platforms provide a high degree of convenience when it comes to buying, selling, and trading cryptocurrencies, they are also a weak link. With their infrastructure issues and status as custodians of customer funds, it’s evident things need to change soon.

Decentralized vs. Centralized Exchanges

On a traditional, centralized exchange, users place their trust in a single party to store their funds, execute trades and protect their confidential information. Centralized exchanges are for-profit companies that make money from fees associated with each trade. Because these exchanges store cryptocurrency on behalf of their users, they are lucrative targets for hackers. Since the beginning of 2018, hackers have stolen more than $700 million worth of cryptocurrency. Centralized exchanges have user-friendly interfaces and are utilized by the majority of cryptocurrency traders because their centralized order books offer advanced trading features and large amounts of liquidity.

Decentralized exchanges, on the other hand, do not rely on a third party to conduct trades or store cryptocurrency. Instead, they use blockchain technology to enable peer-peer trading without an additional third party. Because decentralized exchanges don’t have to be for-profit entities, they can provide fee-less or close-to-free cryptocurrency trading much cheaper than the fees associated with centralized servers. However, current decentralized exchanges are generally difficult to use for common cryptocurrency traders and also lack advanced trading functionality and liquidity.

Solving the Liquidity Problem

Decentralized trading solutions are slowly gaining traction. The 0x protocol as well as barterDEX and other solutions are all becoming popular now. However, there is still some concern over liquidity.

Let’s look at cash, which is the most liquid asset. If a transaction of $1 million takes place, the market is able to absorb that transaction easily without the value of the dollar drastically changing. Costs associated with the transaction, and the value of the currency at the time of the transaction, are also known beforehand.

However, the same transaction in bitcoin, or any other cryptocurrency, has a much greater effect on the cryptocurrency’s value. This is because of the market’s lack of liquidity. The amount of cryptocurrency available on a specific trading platform can run out, requiring the buyer to complete the transaction at 1-10 percent more than expected.

To complete the same transaction of $1 million, it could end up costing between $10,000 and $100,000 more than the original price to make the trade.

One approach to solving the challenges that exist in decentralized exchanges is to reduce the cost of the switch for cryptocurrency traders. If an on-chain platform can tap into multiple reserves, and lower the barriers of switching from one exchange to another by working with various wallet providers, then users can log into their wallets and execute a token conversion without ever leaving their wallets.

This allows receipts to access payments from any token that a decentralized platform supports.

One such token-to-token idea that has become reality is 0x, a cryptocurrency-asset that started its Initial Coin Offering on 15th of Aug 2017. 0x is a protocol for decentralized exchange on the ethereum blockchain that could provide liquidity to all decentralized exchanges.

The 0x project provides a solution for this decentralized liquidity issue by enabling the use of a common smart contracts, optimization trade operations etc by all blockchain exchanges on ethereum. This eases arbitrage operations between exchanges and thus creates more liquidity.

There is also the role of market maker to bring liquidity to an exchange. A market maker is a party that provides bids and asks in a given instrument at all times, and forms what is called the bid-ask spread. They are willing to buy and sell an asset at all times, and their buy and sell prices are reflected on a given exchange.

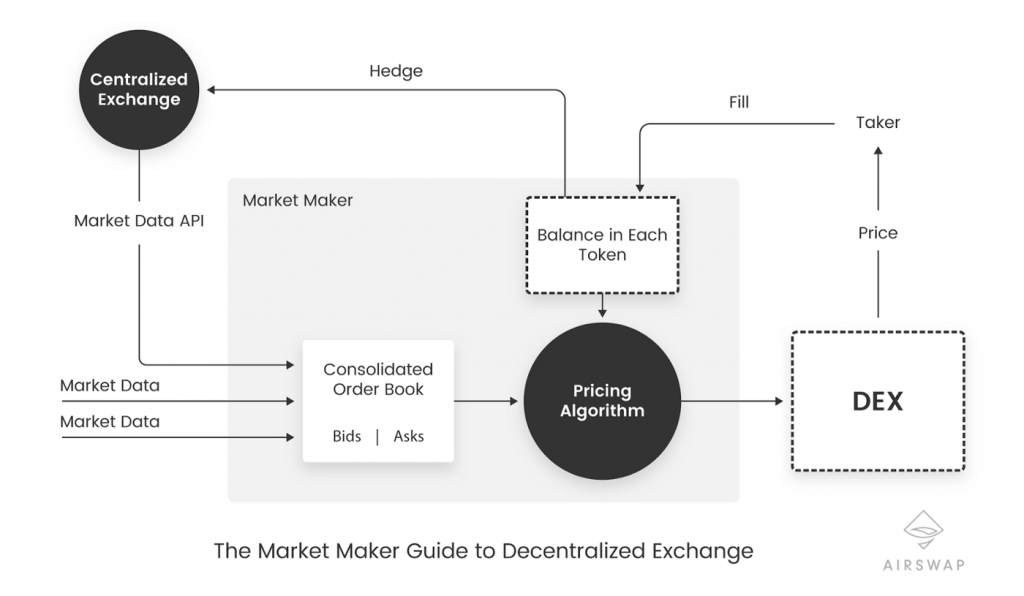

As an example we can see how a liquidity provider will behave and operate on the decentralized exchange Airswap. The diagram below shows how a user can build a market maker that brings liquidity from centralized exchanges to decentralized exchanges.

Decentralized Infrastructure

Building out this infrastructure in which anyone can participate is difficult. Running network nodes in a decentralized manner has proven to be quite challenging for most cryptocurrencies. Even in the Bitcoin world, there are a lot of centralized nodes, mainly because people host them on web servers controlled by the same companies.

The cryptocurrency sector has seemingly lost track of its decentralization aspect as of late. Restoring those norms and values will not be easy, but it is something which passionate community members can work on. A decentralized internet protocol-level cryptocurrency-oriented solution will certainly introduce a lot of changes, but it remains to be seen how feasible this concept really is in the long run.

Hybrid Exchanges

Interoperability is also key for mass adoption of DEX in the crypto community. This opens up a new industry for hybrid exchanges, called HEX. These will be a transitional form of exchanges that take the best of both types of exchanges. A HEX uses decentralized architecture for control of your funds and a centralized database for matching transactions on the market dynamically. When a transaction is finalized, it is then published on the Blockchain.

This is all proof that we are in the early stage of DEX development and there are growing pains, however, companies and thought leaders in the Blockchain ecosystem are focused on resolving these issues. There are other projects that are still in development and working to bring a great DEX experience to market later this year. It will take some time for us to get there, but DEXs are the future of trading. Centralized exchanges will not disappear completely due to the ability to exchange fiat to crypto, but will play an ever decreasing part of the crypto economy, as DEXs become ever more widespread and easier to use.

Comments are off this post!