Going by the range of crypto-related products expected along the line – ICE/Bakkt platform launch, ETF approval and US federal court finding that virtual currencies are commodities, talks of institutional money flowing into crypto as the year runs to an end have seemingly received another boost. Though the probability of the inflow becoming a reality lies in the actualisation of these products which cannot be confirmed as certain at this point, the result of a survey conducted by Thomas Lee’s Fundstrat seems to be in line with the overall view.

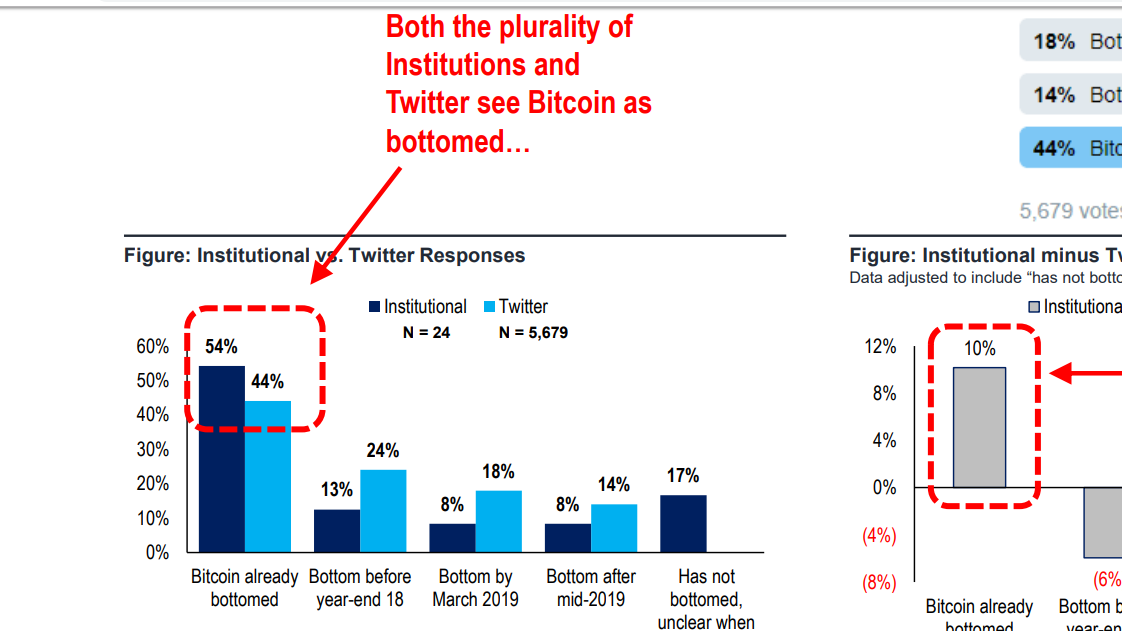

Findings from a Fundstrat’s crypto-Twitter survey show that both the plurality of institutions and Twitter see Bitcoin’s price as bottomed – institutions are much more confident of this fact. The findings which come from one survey conducted during a dinner with 25 institutions (10 questions) and another 6-question crypto-Twitter survey which had ~9,500 responses, also notes that Bitcoin’s market price will grow to

$15,000 or more by the end of the year.

More of the respondents (39%) – with no choices written down for them – believe the Bakkt platform launch, for example, will bring about positive institutional adoption of crypto. They see adoption/use case (24%), ETF/Retail (15%), custody/privacy (12%) and Bakkt/institutional capital (12%) as positive catalysts for crypto in coming months.

Almost 60% of institutional respondents choose Bitcoin as one of the top 15 cryptocurrencies to perform well in 2019. With the finding, it is easy to conclude that Bitcoin will be the primary interest for institutional investors. On the other hand, 46% of the responses from Twitter choose Ripple (XRP) despite its being seen by the respondents as the investment thesis that makes the least sense.

Majority of the respondents share that central banks are the most important macro factor that influences the price of cryptocurrencies – though most of the institutions surveyed choose geopolitical tension. 52% see regulatory uncertainty/clarity/SEC as the top negative catalyst for cryptos followed by security (10%).

Comments are off this post!