Based on conservative estimates of gross margin of 75 percent and operating margin of 65 percent, Bernstein analysts calculate that Beijing-based Bitmain made $3 billion to $4 billion in operating profits in 2017. This secretive Chinese start-up that dominates the Bitcoin “mining” industry is estimated by Bernstein analysts to have made as much as chipmaker Nvidia did last year.

This estimate is based on conservative estimates of gross margin of 75 percent and operating margin of 65 percent, the analysts calculate that Bitmain made $3 billion to $4 billion in operating profit in 2017. Bernstein’s U.S. semiconductor team estimates Nvidia’s operation profit was $3 billion during the same period.

The Bernstein analysts said in a report published Wednesday last week:

“But Bitmain achieved this in merely four years, while it took Nvidia 24 years to get here,”

2017 was an extremely profitable year for Bitmain Technologies Ltd., a privately owned Bitcoin mining company headquartered in Beijing, China. In addition to operating several of the world’s largest Bitcoin mining pools, Bitmain manufactures ASIC chips and the mining hardware that uses those chips. All total, the company raked in somewhere between $3 and $4 billion in profits last year, according to estimates made by Bernstein Research.

GPU manufacturer Nvidia’s operating profit was $3 billion during the same period, meaning Bitmain made roughly the same amount of money in 2017 as the technology industry giant. However, Bitmain achieved their success in only a fraction of the time – 1/6th, to be exact. Bitmain achieved this in only four years, while it took Nvidia 24 years to get here.

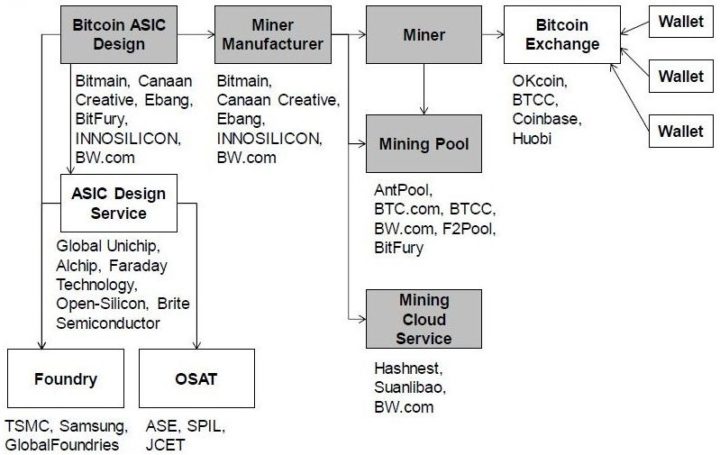

Bitmain’s rapid success stems from several sources of revenue within the Bitcoin mining supply chain, as shown in the following diagram from the Bernstein report:

Bitmain generates its revenue from several parts (highlighted in gray) of the bitcoin mining supply chain:

In the early days of bitcoin, miners could use ordinary video graphics cards to profitably to mine bitcoin. But a Chinese-based company turned bitcoin mining into a specialised process in 2013 by selling application-specific integrated circuits, or asic, computer chips that could mine bitcoin 50 times faster than traditional video graphics cards.

Today, Bitmain sells Antminer bitcoin mining rigs that can cost several hundred dollars to a few thousand dollars each. The company also operates “mining pools” in which participants collaborate on bitcoin mining in order to cut costs. As a result, Bernstein estimates Bitmain has 70 to 80 percent of market share in bitcoin miners and asics.

The analysts estimate that most of Bitmain’s revenue was generated by selling miners powered by the company’s chips.

“The rest was largely generated by mining itself and, to a much lesser extent, by collecting management fees from the mining pools it operates and renting out the mining power of its mining farms through cloud services.”

Much of the growth in mining revenue came from the exponential rise in bitcoin prices, the Bernstein report said. Its analysis also indicated that “Bitmain shrewdly adjusts the prices of miners according to bitcoin prices.”

So as bitcoin skyrocketed toward $20,000 late last year, the price of Bitmain’s AntMiner S9 climbed near $5,000 while production costs remained the same, according to Bernstein’s estimates.

To come to the final $3 billion to $4 billion operating profit figure, the Bernstein analysts also looked at Bitmain’s purchases from Taiwan Semiconductor Manufacturing and estimated the start-up contributed 2 to 3 percent of the chipmaker’s total revenue last year.

The report said:

“In the year 2018, Bitmain will likely lead the cryptocurrency asic industry and migrate some of its chips to 10nm and the most advanced 7nm. That will make the company one of the top five users of TSMC’s 7nm in 2018, with demand comparable with Qualcomm’s, HiSilicon’s, or AMD’s.”

Secondly, Bitmain operates mining pools, which cuts down on mining costs by allowing miners to collaborate their efforts.

Thanks to their dominance on all fronts, Bernstein estimates that Bitmain holds claim to somewhere between 70 percent and 80 percent of Bitcoin mining’s total market share.

The report said:

“Some money is left with customers, but so are a lot of risks. The results, in our view, have been remarkable.”

But longer-term growth is not guaranteed, especially in the volatile cryptocurrency world. Chinese authorities have taken some of the strongest actions so far by banning initial coin offerings and causing local bitcoin exchanges to close.

In order to stay ahead of the game the company launched a mining pool subsidiary last April in Israel, and is opening mining farms in Canada and Switzerland, and regional headquarters in Singapore. Bitmain is also expanding its business to other cryptocurrencies such as ethereum and monero.

The Bernstein analysts say that Bitmain also has a “massive cash position” that should help it through slow periods in the industry. And in its main bitcoin mining business, the Chinese company protects itself from losing too much to investor speculation by selling chips to miners, rather than doing all the bitcoin mining on it’s own.

Comments are off this post!