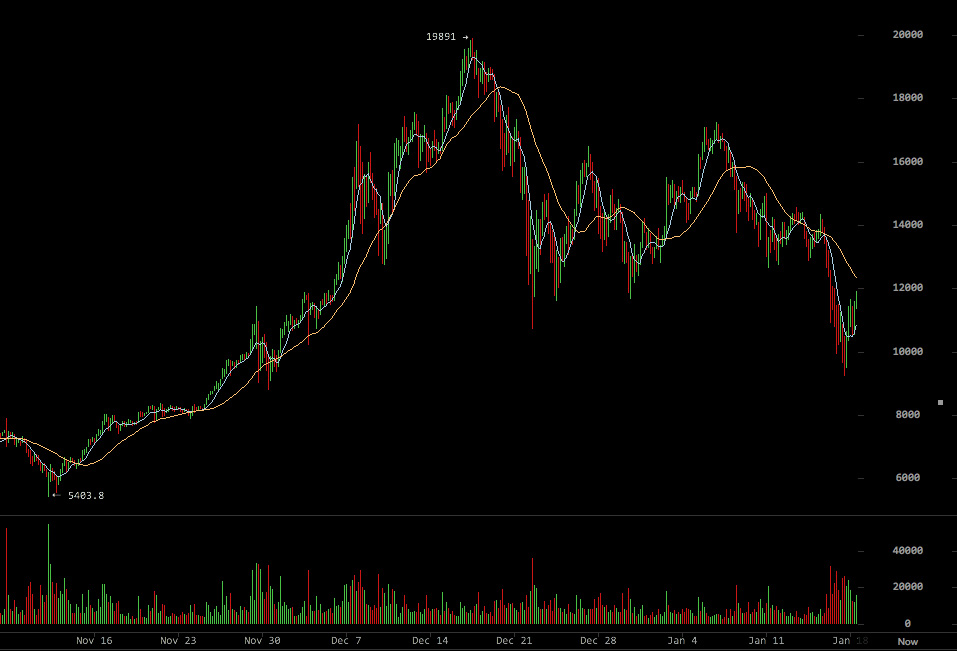

Bitcoin’s volatile start to 2018 ramped up a notch on Wednesday, with the largest cryptocurrency falling below $10,000 for the first time in six weeks before staging a recovery to trade virtually unchanged on the day.

The moves took the crypto asset across a trading range of more than $2,600 over 18 hours. Its fall to a low of $9,186 meant the monthly fall amounted to a heady 50 percent. Bitcoin rebounded $1,600 in the next four hours to trade at $10,780 as of 3:44 p.m. in New York, according to pricing data from coinmarketcap.com

The drama Wednesday was most likely influenced by increased scrutiny from regulators around the world particularly from China and South Korea where government officials are calling for more regulation.

Ari Paul, chief investment officer of BlockTower Capital said:

“Bitcoin was overbought and sentiment was ecstatic. This is an overdue correction triggered by South Korean regulation fears.”

In South Korea, regulators warned they may shut down cryptocurrency exchanges completely after limiting their operations. China is said to have intensified its curbs on trading of the digital coins, extending restrictions to over-the-counter and peer-to-peer platforms after banning exchanges last year. In the U.S., the Securities and Exchange Commission asked at least 15 funds to pull applications this month for bitcoin-related exchange-traded funds.

That’s left speculators across the globe struggling to determine when or how market watchdogs may rein in an industry that is decentralized and derives much of its value from anonymous ownership.

Joe Van Hecke, managing partner at Chicago-based Grace Hall Trading LLC said:

“We get sell offs like this fairly regularly. I think this one is more pronounced and press-worthy since it is affecting more people and the dollars at stake are greater. It’s a great time to evaluate which of these coins have staying power, actually have utility going forward, and invest in those.”

Souring the mood in the market, cryptocurrency exchange Bitconnect said it’s shutting down after receiving two cease-and-desist letters from state authorities for the unauthorized sale of securities and suffering from denial-of-service attacks, while one of the biggest trading platforms, Kraken, was offline for over a day last week as a scheduled update went awry.

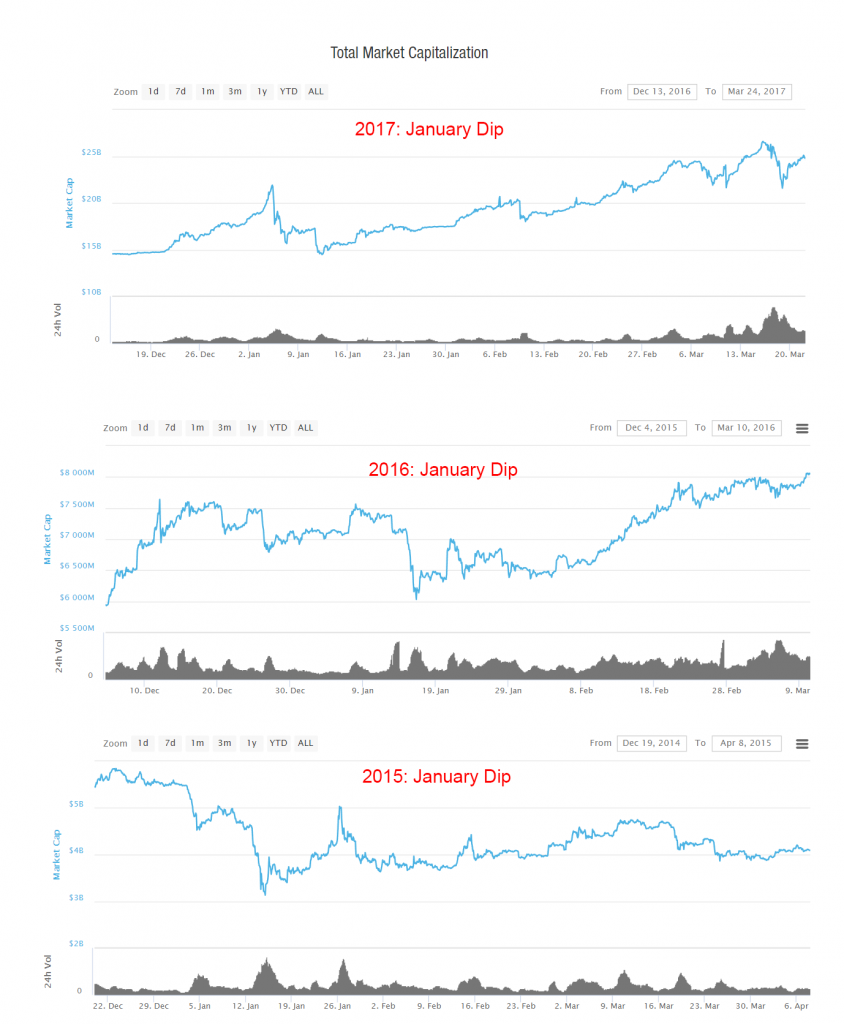

It is notable that this dip in price has happened at a similar time over the last two years in January (2016 and 2017). This may be due to Asian traders cashing out their cryptocurrencies to travel and buy gifts for the holiday that starts Feb. 16 this year. Another factor may be that people in the US sell in January to defer their capital gains tax liability an extra year.

The sell-off has been amid relatively high trading volume, with around 400,000 bitcoin exchanging hands on Jan. 15, the highest since Dec. 21.

Many assertions that digital coins represent a bubble have triggered double-digit selloffs over the past year, often to be followed by rebounds. It fell 26 percent in a week after reaching its peak in mid-December, only to rally 21 percent in the next 10 days. Since then, its posted only two gains in eight sessions.

Bitcoin’s market value has dropped to about $170 billion from a peak north of $310 billion. The December surge began after the U.S. Commodity Futures Trading Commission agreed to allow trading in bitcoin futures. The digital coin is still higher by almost 1,000 percent from a year ago.

BlockTower’s Paul said:

“There are a great many investors that are excited to see Bitcoin below $10k as a second opportunity to enter at a price they feared they’d never see again,”

Comments are off this post!