Constructive criticism is always welcome, yet the arguments we often hear from ‘esteemed’ economists and investors generally appear to be weak and clueless with very little understanding of the fundamental technology behind Bitcoin. In this article we will take a look at three major figures in investment and economic world to appraise their negative take on Bitcoin.

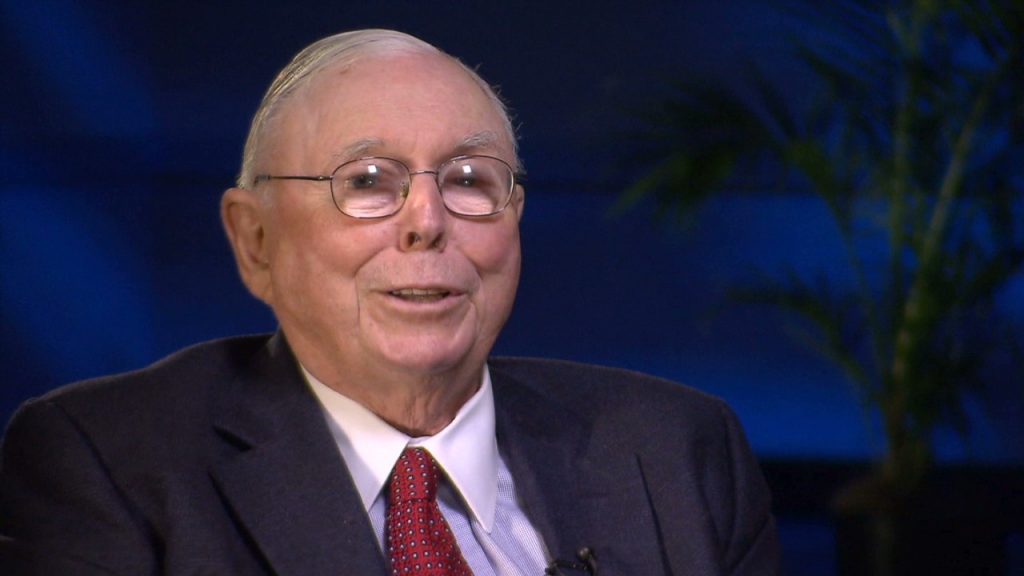

Charlie Munger

The latest institutional doyen to vent their vitriol on Bitcoin is non-other then Charlie Munger, Warren Buffett’s long-trusted deputy. Charlie Munger, the 94-year-old billionaire investor, is convinced that bitcoin is “noxious poison”.

“I regard the bitcoin craze as totally asinine,” he told a packed hotel ballroom in downtown Los Angeles, where hundreds of what he called “groupies” gathered to listen to their idol.

With the prolific and seemingly unstoppable sentiment driven rise of Bitcoin and cryptocurrency, it seems Munger has well and truly had his feathers ruffled. Speaking about bitcoin in Los Angeles he displayed all the hallmarks of classic cognitive bias, saying:

“I detested it the minute it had been raised. The more popular it got, the more I hated it.”

Yet despite a lack of understanding Munger is quick to definitively state that someone out there is “capable of somehow creating more bitcoin.” He also rehashes the old criticism that bitcoin is full of “crooks, crazies, egomaniacs, people full of resentment, people full of self-pity…..avoid [Bitcoin] like the plague”.

Unfortunately Munger’s bias frames his perspective, as he told the audience that if that is the case them “all of these things [like bitcoin] are beneath you”. Bitcoin people, he continued, are “not my kind of people.”

According to Munger, however, regulators should “let up” on Wells Fargo despite multiple instances of fraud. In defending the bank it is important to note the use of euphemisms that serve to dilute, distract and soften the tone in regards to criminality. Munger says Wells, like many other banks, had misaligned “incentive systems” and they will be “better off” because “they’ve learned”.

But to specifically dissect Munger’s personal bias we need to examine his qualifying remarks. “I expect the world to do silly things from time to time, because everyone wants easy money without much insight or work” he commented, “it’s just disgusting that people have been taken in by this.”

What this shows is that Munger missed one of the investments of any century simply because his bias dictated that making “easy money” from something he doesn’t understand is not valid, if he deems that you didn’t work especially hard or display much insight.

But what of the people who recognized that public sentiment against government, financial institutions and payment processors has been markedly shifting since the financial crisis? Is that not displaying insight?

Bitcoin has also rarely been easy work — ask any individual or business who survived through its 2014-15 downturn: “Bearwhale”, China bans, Mt. Gox, GAW. As the price plumbed the depths of an almost full retrace, those who bought the “blood in the streets” — a concept made famous by Munger’s boss — have now profited enormously. Does Munger considers people profiting from an asset in the midst of a pronounced bull run as somehow undeserving? Is this not exactly the same as Berkshire Hathaway buying Goldman Sachs during the financial crisis of 2008?

The shares in the banking giant had collapsed when Berkshire and Buffett publicly stepped in and struck a deal that he referred to as a “bet on brains” where he would purchase $5 billion USD worth of stock and be offered “warrants to buy 43.5 million shares of the bank’s common stock for $115 anytime before October 2013.” This deal eventually saw Goldman buy back the preferred stock for over $5.6 billion (the difference between the price and Buffett’s ‘strike’ price).

Buffett negotiated the deal on September 24th and a bank bailout deal was approved on October 3rd, 2008, a week later. It’s possible Buffett was able to negotiate this deal because of his financial clout. The very fact that such a famous name was backing Goldman calmed the markets; good for Buffett, good for the bank and good for the government that needed some positive PR. The question remains as to whether Buffett would have invested $5 billion without some kind of inkling that a bailout deal was in the works.

Yet perhaps the gesture would have been received differently had the public known that Goldman itself had implicitly threatened to collapse the financial system if Hank Paulson refused to bailout the banks; an infusion of money that Matt Taibbi described as “one of the biggest and most elaborate falsehoods ever sold”. Goldman Sachs, already teetering on the verge of collapse, stood to lose $20 billion due to their loans to the dumpster fire of risk management that was the insurer AIG, an insurmountable loss.

To assess the position of Charlie Munger, you must understand the system under which Berkshire Hathaway has thrived. For the past 100 or so years the U.S. Federal Reserve has run the book of the financial markets in much the same manner as a market maker does with any altcoin.

Buffett and Munger have adapted a value investing methodology to succeed in this system where the government acts as a backstop to the markets, regulating some industries and deregulating others. Traditionally Berkshire has invested in companies that retain some kind of advantage in this regard.

As such Berkshire Hathaway advocates for government intervention and control where assets are tangible, insured and able to be depreciated. It is not surprising to note then, that Munger is calling for the government to react to bitcoin and “step on it hard. That’s the government’s job.”

Paul Krugman

Paul Krugman’s complete disdain for Bitcoin goes back a long way. In late 2013, he wrote a piece entitled “Bitcoin Is Evil” for his column in The New York Times. Krugman does not see much utility in the cryptoasset at all. Like many of the other establishment ‘haters’ of Bitcoin he has been able to express his hatred quite clearly, but his technical criticisms of this new type of asset and store of value are woefully inadequate.

In a series of tweets on Sunday, January 21, 2018, Krugman illustrated his ignorance on the usefulness and utility of bitcoin around the world.

The opening tweets were probably some of the nicest things the Nobel Laureate has ever said about bitcoin.

Krugman tweeted:

“As I see it, cryptocurrencies like Bitcoin are in effect like digital gold coins, in the sense that they can’t be counterfeited … Cryptocurrencies use cryptographic techniques plus distributed storage to create non-material entities that are nonetheless impossible to fake,”

As I see it, cryptocurrencies like Bitcoin are in effect like digital gold coins, in the sense that they can't be counterfeited. A gold coin is worth its weight in gold, no more, no less; if you're suspicious, you can bite it to make sure 2/

— Paul Krugman (@paulkrugman) January 21, 2018

Digital gold is still the best analogy to sum up the digital asset’s value proposition, and the utility of bitcoin should become more apparent as the world moves deeper into a cashless society. In a cashless society, bitcoin would become the last financial bastion of freedom in a world where the global financial system is under complete control of governments.

Later on Krugman loses the plot somewhat with the claim that online payments that don’t involve a trusted third party aren’t that important. However, as Nick Szabo is fond of saying, trusted third parties are security holes.

Krugman tweeted:

“Cryptocurrency lets you make electronic transactions; but so do bank accounts, debit cards, Paypal, Venmo etc. All these other methods involve trusting a third party; but unless you’re buying drugs, assassinations, etc. that’s not a big deal,”

The moral question is one of the most oft touted arguments against Bticoin, but do people say the same about cash and ATM’s and how many drug deals and other crimes are conducted using cash? Either people will use it or they won’t. Whether you like what they’re doing is a different matter. Bitcoin’s use in darknet markets, ransomware, online gambling and other fringe areas cannot be ignored. Utility is utility.

Secondly, not everyone has access to PayPal, Venmo, and other online payment platforms. They are highly regulated, which means plenty of people fall through the cracks and cannot gain access to them.

Krugman goes on to point out the clunkiness of Bitcoin as it exists today, and in that aspect he’s more or less correct. But what he fails to realise is that the problem is the depth and breadth of all possible uses has made the system difficult to scale, but scaling solutions are coming. All he has to do is look at the progress being made with SegWit and Lightning Network.

Krugman then turned to the often-used argument that bitcoin lacks any sort of underlying value. This should come as a surprise, since he just laid out how it is useful for illicit digital payments.

Krugman tweeted:

“Meanwhile, what backstops a cryptocurrency’s value? Paper money is ultimately backed by governments that will take it in payment of taxes (and central banks that will reduce the monetary base in case of inflation). Gold is actually useful for some things, like filling teeth and making pretty jewelry; that’s not most of its value, but it does provide a tether to reality, along with a 5000-year history,”

Krugman continued.

“Cryptocurrencies have none of that. If people come to believe that Bitcoin is worthless, well, it’s worthless. Its price rise has been driven purely by speculation — by what Robert Shiller calls a natural Ponzi scheme, in which early entrants make money only [because] others buy in.”

If bitcoin is useful for permissionless digital payments, then it has the same sort of underlying utility that the U.S. dollar has in the form of tax payments.

Additionally, the U.S. dollar would also become worthless if people woke up one morning and came to believe that it was worthless.

Of course, all of this misses the point anyway. How much of the value of all the U.S. dollars in the world comes from its use in tax payments? How much of the value of all the gold in the world comes from its use in electronics? Not much.

Krugman misses that storage of value is also a form of utility, and bitcoin is the most uncensorable, unseizable store of value the world has ever seen. You can walk around with a passphrase in your head that can unlock access to thousands of bitcoins, and no one would be the wiser. Not to mention there is no centralized party that can inflate the supply like the Fed or ECB is doing with the dollar and the euro.

Krugman also touched on the high potential for manipulation in the bitcoin market, pointing to a paper regarding the manipulation of the bitcoin price by now-defunct bitcoin exchange Mt. Gox, as an example.

This is another claim with some basis in reality, but it ignores the massive amounts of manipulation and lack of transparency in the traditional financial system, which is what led to the creation of bitcoin in the first place.

Through the use of cryptographic proofs, bitcoin has the potential to become much more transparent and trustless than the traditional financial system. Bitcoin’s monetary policy is already much more transparent than what goes on at the Federal Reserve. There’s a reason someone put up a “Buy Bitcoin” sign while Federal Reserve Chairwoman Janet Yellen spoke against the need for further audits of the central bank.

Bitcoin exchanges are highly centralized institutions, which opens the door for manipulation. However, these exchanges have also become much more regulated over time. Today, it’s far more difficult to run an exchange at the level of incompetence that was found at Mt. Gox.

The potential for market manipulation should decline as the technology around bitcoin improves. Eventually, more trades may take place on decentralized exchanges, where it’s impossible to fudge the numbers.

In his last tweet from his thread on Sunday, Krugman said it’s unclear if the Bitcoin blockchain — or any blockchain for that matter — is useful.

Around $3 billion worth of bitcoin has been transacted on the Bitcoin network per day this year, according to Blockchain; $75 million worth of bitcoin per day was the norm the day Krugman first published an article on the subject.

Krugman’s arguments, as well as arguments from other well-known economists, have not changed much since 2013, but the Bitcoin network has continued to grow. It’s possible that Krugman and his colleagues are unable to comprehend the usefulness of bitcoin as an asset because it does not fit into the regulated, controlled environment they’ve built their economic and political worldviews around.

Nouriel Roubini ( AKA Dr. Doom)

Nouriel Roubini is a New York City University professor of economics, who is also known for his collaborations with the World Bank, the International Monetary Fund and the US Federal Reserve, has predicted the financial crisis. After this successful estimation of his, many economists have looked up to him and listened to his financial advice.

Perhaps that it was also inevitable for him to move on and criticize the digital response that came to the financial crisis he correctly predicted. As a banker who collaborated with three of the biggest financial institutions of the world, it makes sense that he defends fiat currencies and advocates for his own vision in regards to the monetary policies.

And under these considerations, back in 2014 he boldly called Bitcoin a Ponzi scheme and an instrument for criminals and illegal traffickers to undergo their activities. The most recent event at the time was the collapse of the Mt. Gox exchange, and the subsequent volatility led the elite economist to erroneously think that the move was part of a grand centralised scheme which sought to enrich a bunch of computer nerds.

He didn’t seem to understand how Bitcoin works and his statements were not backed by any kind of research on the underlying blockchain technology and nodes.

This Time It’s Personal

The growth of the Bitcoin displeases him personally for the damage it does to his reputation as an economist, and it’s very likely that the institutions that pay him for various services regarding his field of expertise aren’t happy either. Why would anyone from the World Bank or International Monetary Fund be happy, anyway?

However, it seems like the last 3 years and a half have given him enough time to do a little research on the matter. This time he tackled the comparison that people usually make with the Internet (or the “Dot com bubble”, depending on the side you’re on) and argued that the comparison with the blockchain technology is wrong. He must have never heard about smart contracts or applications that are built on the blockchain, and believes that cryptocurrencies are the only application and a failing one at that.

He tries to look knowledgeable of the subject by mentioning that Bitcoin has “forked off” in three branches: Bitcoin Gold, Litecoin, and Bitcoin Cash and uses this to call the deflationary aspect of Bitcoin ‘fraudulent’.

He does not seem to realise that all cryptocurrencies do have an equivalent in Bitcoin and that ultimately believing in Bitcoin does not mean that you have to embrace all Altcoins and every ICO. There are many in the crypto community who would like to see less of both.

Conclusion

With some of the most respected minds in the financial world calling for government action there can be no doubt that many in the halls of government are doing the same.

The bias shown by the likes of Munger and Roubini may be the least of Bitcoin’s worries, for the wrath of a U.S. government clampdown may be the ‘final boss’. However, as it shrugs off each serious challenge thrown at it, Bitcoin may just be strong enough to win out despite the mountain of entrenched opposition it faces.

Comments are off this post!