In a surprising move due to the high electricity costs and lack of cold temperatures, a British IT hardware supplier, has recently revealed plans to build a Bitcoin (BTC) farm in the South East of United Kingdom, The Sunday Telegraph reported March 17. A team of of entrepreneurs is planning to build a £10m Bitcoin farm in the South East that it claims will be the biggest in the UK.

Bladetec, a company set up in the early 2000s that has supplied high-powered IT equipment to the Ministry of Defence and Nato, is aiming to build the 3,500-square foot facility across three locations in London, Surrey and Suffolk.

The project is called Third Bladetec Bitcoin Mining Company Ltd (TBBMC) and the plan is to raise £10 mln or roughly $13.9 mln from investors to build and operate the farm over the next two to three years. The developers then plan to sell off the mined coins as well as the mining equipment to provide investment returns, says the funding platform for the project, Envestry.

Bladetec founder John Kingdon claims that investors “don’t risk losing any money”. According to his calculations, sale of the mining equipment alone would result in profit; it’s unknown whether he took into consideration factors such as decreasing hardware prices and increasing mining costs that require more electricity and computing power every year.

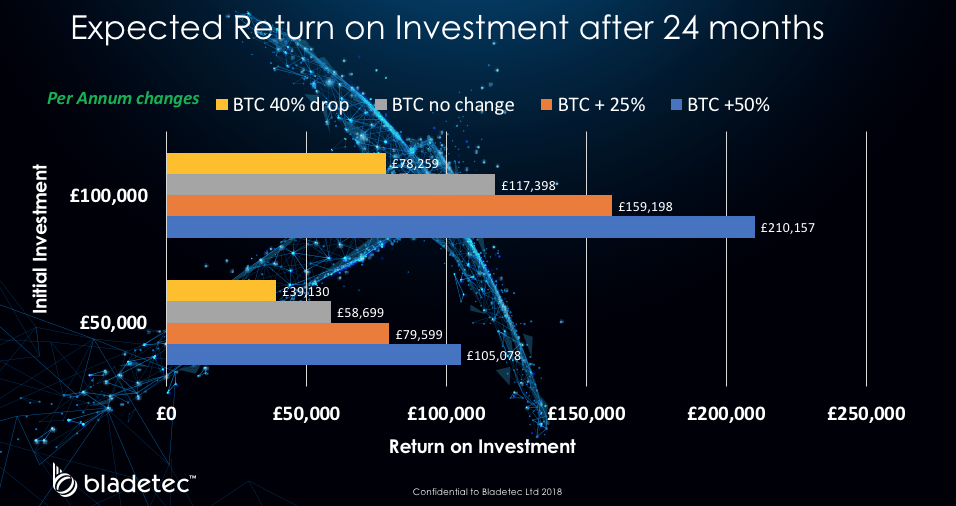

TBBMC expects investment returns to follow one of four scenarios depending on the value of Bitcoin in the next two years. The scenarios range from a per annum price drop of up 40 percent, to a per annum price increase of over 50 percent.

Details on its website reveal that Bladetec is seeking a minimum investment of £5,000 per investor with shares sold at £1.00/share par value with funds used to purchase mining hardware and pay for electricity, site and admin costs. The company will be 100% shareholder owned, Bladetec added.

Declan Kennedy, CFO and one of three admins who will manage TBBMC said:

“We are entirely focused on maximising shareholder returns and so, understanding the relatively volatile nature of Bitcoins, we have allowed for four different growth scenarios with up to 45% capital growth per annum,”

Bladetec has provided IT support, supplying, and consulting services to such bodies as the UK Ministry of Defence, NATO, and The National Grid since it’s inception in 2002. TBBMC will be the first Bitcoin mine in Europe funded by investors in a limited company protected by UK law, according to Evenstry.

The TBBMC facility will cover 3,500 square feet at three locations in London, Surrey, and Suffolk. Considering the high price of mining one bitcoin in the UK, which reportedly amounts to about $8,400, most of the raised funds would be spent on energy costs, as the company is planning to mine 1,280 bitcoins, writes The Telegraph.

Comments are off this post!