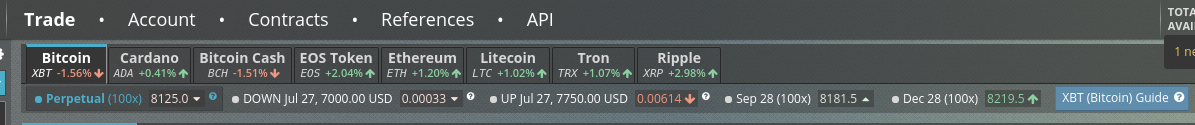

A lot of crypto traders trade on Bitmex. It’s one of the most advanced trading platforms I’ve ever seen. The most professional traders mostly trade on Bitmex. There are multiple reasons for a trader to trade on Bitmex.

- No KYC requirements

- High Leverage

- Altcoin futures

TL;DR

A negative funding rate means that shorts pay longs.

A postive funding rate means that longs pay shorts.

You basically get paid every 8 hours if you trade against the trend. If not, you pay interest every 8 hours.

Shill link to create an account on Bitmex and get 10% fee discount: https://www.bitmex.com/register/LeIJ7G

Future contracts is a legal agreement that allows buyers and sellers to speculate on what the future value of the underlying asset (BTC) will be.

A lot of new traders who have a strong believe in a future price (short term) tend to use a lot of leverage. On Bitmex your profit and losses will be dominated in bitcoin.

At settlement, the futures price must equal the underlying spot price. If it doesn’t than you are not trading futures contracts. On Bitmex for their contracts settlement happens in a 30 minute time weighted average price. Take the the price of BTC on the relevant exchanges and every minute they snap the price and take a weighted average of that. That determines their settlement price. After settlement occurs, your position is gone/closed.

Swaps

A lot of traders don’t like it that their positions “expired”. They often don’t understand why they have no position open anymore. So Bitmex created a contract that never expires. So they created a “synthetic margin trading instrument” because a lot traders in crypto understand margin trading but when they move to the derivative space, they get confused. In order to solve that issue, Bitmex created a perpetual swapwhich doesn’t have an expiry date. What they have done is created a never ending sequence of 8 hour future contracts and they do charge interest rate that is based on the premium discount that is observed between the actual price of a swap contract and the underlying price of BTC. They take a 8 hour T-wap every minute and check the premium or discount of the swap and they will charge that as a funding rate in the future. Your funding payment is the size of your position in BTC times the funding rate. They charge this funding every 8 hours.

If you didn’t know what a perpetual swap is, you are probably using that right now. Perpetual dictionary meaning: continuing forever in the same way.

A negative funding rate means that shorts pay longs. In a previous 8 hour period, the swap was trading at a discount to the underlying spot price. So traders who are short need to pay for their position. You basically get rewarded to trade against the trend.

If the funding rate is positive, longs will have to pay shorts. Bitcoin has been in a bull market for the last couple of years. So generally shorts will earn btc by keeping their position open. However at the time of writing this, Bitcoin went down from $19000+ to below $6000. Fun story, I had small long position at $7.3K stuck for months. However since it was a bear market I earned BTC for keeping my position open. Now BTC is back to $8K, I’m pretty happy about that.

The funding you pay or receive is calculated as:

Funding = Position Value * Funding RateBut this can also be dangerous when the funding rate is for example high and you are trading with high leverage. Using high leverage means that your position value is big. If the funding rate would be for example 1.5%, you are using 50x or 100x leverage for example and the market stops moving, you will get liquidated just because you have to pay the interest rate. It means you were unable to afford keeping your position open. It can encourage people to close their trade before the funding rate has to be paid. Paying “rent” 8 hours if the funding rate is against you can add up really quick on high leverage.

This often leads to interesting events. When funding is expensive, traders close their positions right before and you get those star wars lightsaber candles.

Another scenario is someone wants to close their position in order to avoid paying funding but the market can rally in a “premium” more than he has to pay funding. This can lead to a loss bigger than the funding was about to be. If you want to open a trade again, you pay a fee, pay the spread and most likely pay a premium. The market often over correct as traders try to get out of their position before funding is charged and the other side of traders will try to lower their bids or raise their offers.

How to know if you use the Perpetual swap or contracts with expiry date?

- Credit: https://medium.com/@romanornr

Comments are off this post!